January 2026 – MLS Statistics

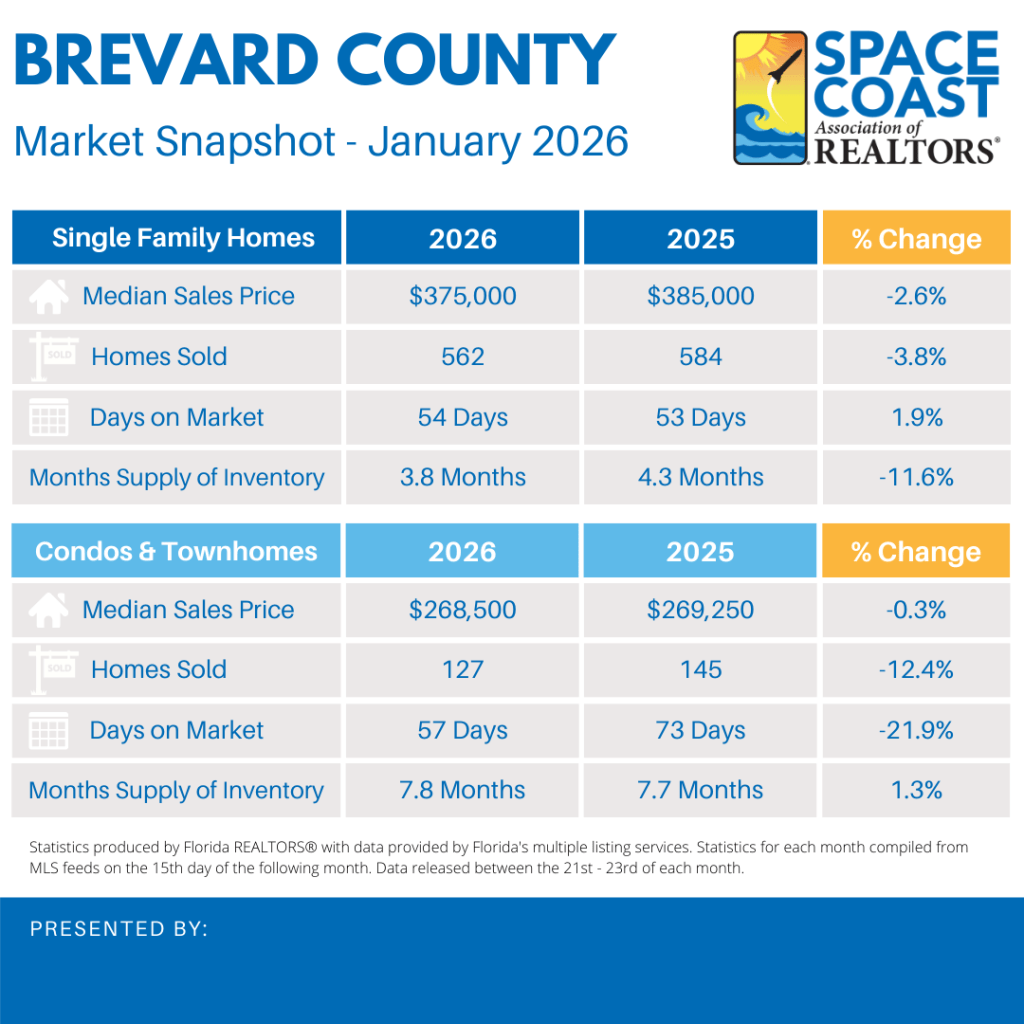

A quick recap of the Brevard County Residential Report for January 2026:

- Closed Sales are down -3.8% for January 2026 in which the number of units closed was 562 compared to 584 in January 2025, with a decrease in cash sales of -12.7%.

- New Pending Sales are down -0.8% and New Listings are down -8.8%.

- The Median Sales Price for Brevard Single Family homes is down -2.6% to $375,000 compared to a year ago, which was $385,000.

- Months’ Supply of Inventory is down -11.6% to 3.8 months, a decrease from 4.3 months in January 2025.

- Traditional Sales are down -4.3% with a median sales price of $375,000.

- Foreclosure/REO Sales are up 50.0% with 6 closed sales and a median sales price of $199,490.

- Short Sale Closings are N/A with 1 closed sale and a median sales price of $325,000

What this means:

The Brevard County residential market in January 2026 showed a slight slowdown in activity compared to last year. Fewer homes closed, and cash sales were down, while new pending sales and new listings also saw modest declines. Home prices softened a little, and inventory levels decreased, giving buyers slightly fewer options. Traditional sales were lower, foreclosures increased but remained limited, and short sales were minimal. Overall, the market reflects a calm, steady environment with opportunities for both buyers and sellers, though activity is a bit slower than in the previous year.

A quick recap of the Brevard County Townhouses/Condos for January 2026:

- Closed Sales are down -12.4% for January 2026 in which the number of units closed was 127 compared to 145 in January 2025, with a decrease in cash sales of -11.4%.

- New Pending Sales are up 20.2% and New Listings are up 7.3%.

- The Median Sales Price for Brevard Townhouses/Condos is down -0.3% to $268,500 compared to a year ago, which was $269,250.

- Months’ Supply of Inventory is up 1.3% to 7.8 months, an increase from 7.7 months in January 2025.

- Traditional Sales are down -14.0% with a median sales price of $270,000.

- Foreclosure/REO Sales are up 100.0% with 4 closed sales and a median sales price of $147,950.

- Short Sale Closings are N/A with 0 closed sales and a median sales price of (no sales.)

What this means:

The Brevard County townhouse and condo market in January 2026 showed mixed activity. Overall sales were lower compared to last year, with cash sales also declining, yet new pending sales and new listings increased, signaling growing buyer interest. Prices remained mostly steady, and inventory levels were slightly higher, giving buyers a few more options. Traditional sales slowed, while foreclosures saw a noticeable rise, though they remain a small part of the market. Short sales were minimal, with no closings reported. Overall, the market reflects steady demand with opportunities for both buyers and sellers in a balanced environment.

MLS Statistics – 1st Quarter 2025

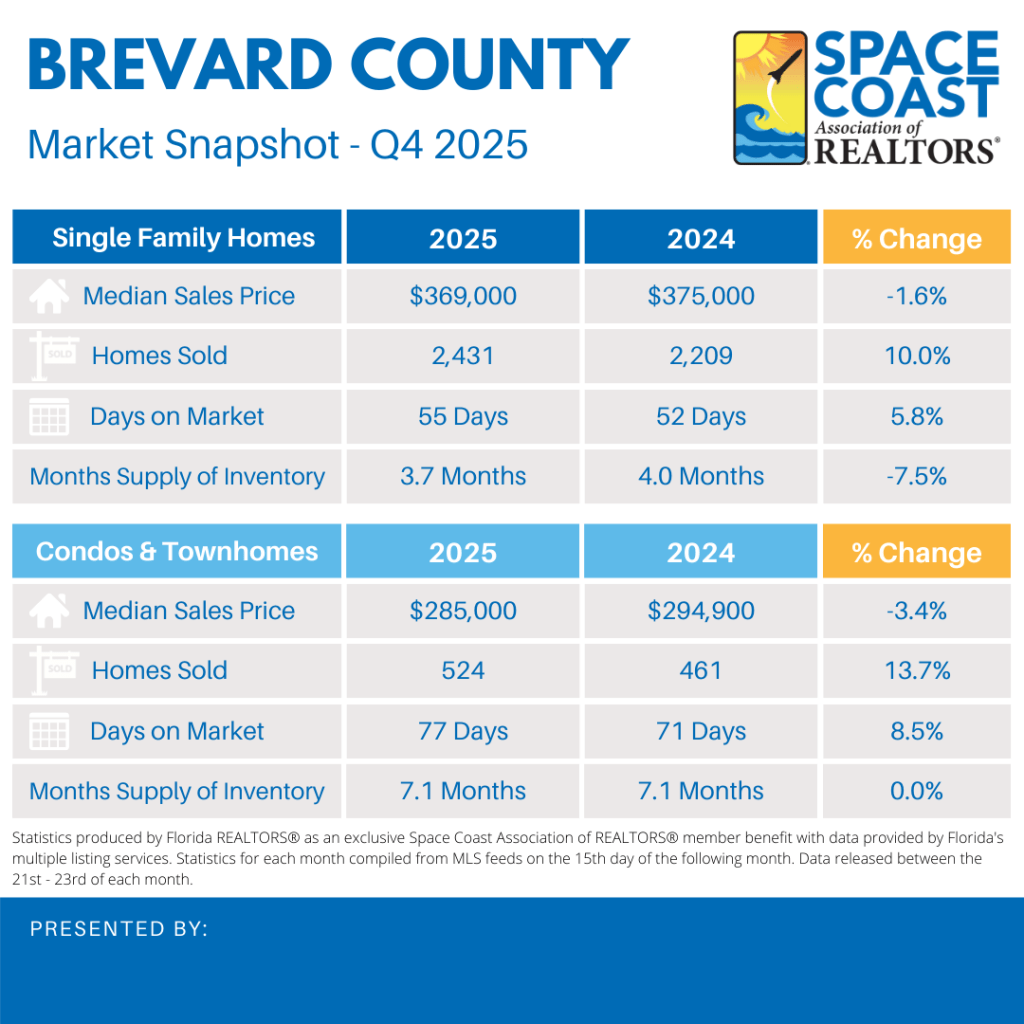

A quick recap of the Brevard County Residential Report for Q4 2025:

- Closed Sales are up 10.0% for Q4 2025 in which the number of units closed was 2,431 compared to 2,209 in Q4 2024, with an increase in cash sales of 11.7%.

- New Pending Sales are up 11.1% and New Listings are up 0.4%.

- The Median Sales Price for Brevard Single Family homes is down -1.6% to $369,000 compared to a year ago, which was $375,000.

- Months’ Supply of Inventory is down -7.5% to 3.7 a decrease from 4.0 months in Q4 2024.

- Traditional Sales are up 8.7% with a median sales price of $370,000.

- Foreclosure/REO Sales are up 328.6% with 30 closed sales and a median sales price of $174,500.

- Short Sale Closings are up 350.0% with 9 closed sales and a median sales price of $325,000.

A quick recap of the Brevard County Townhouses/Condos for Q4 2025:

- Short Sale Closings are N/A with 0 closed sales and a median sales price of (no sales.)

- Closed Sales are up 13.7% for Q4 2025 in which the number of units closed was 524 compared to 461 in Q4 2024, with an increase in cash sales of 30.0%.

- New Pending Sales are up 19.3% and New Listings are up 2.3%.

- The Median Sales Price for Brevard Townhouses/Condos is down -3.4% to $285,000 compared to a year ago, which was $294,900.

- Months’ Supply of Inventory is 0.0% to 7.1 months, no change from 7.1 months in Q4 2024.

- Traditional Sales are up 13.3% with a median sales price of $285,000.

- Foreclosure/REO Sales are up 200.0% with 3 closed sales and a median sales price of $182,000.

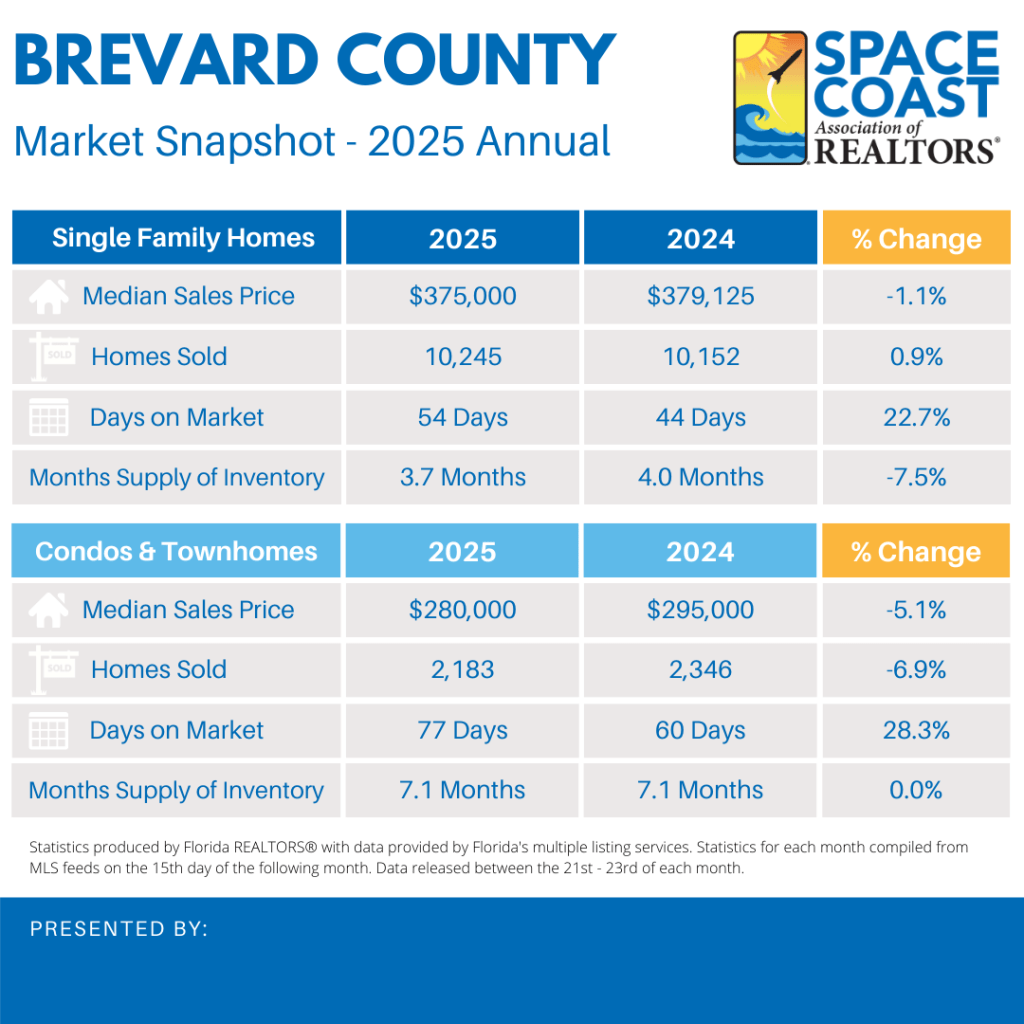

A quick recap of the Brevard County Residential Report for Annual 2025:

- Closed Sales are up 0.9% for Annual 2025 in which the number of units closed was 10,245 compared to 10,152 in Annual 2024, with an increase in cash sales of 1.9%.

- New Pending Sales are up 1.7% and New Listings are down -0.3%.

- The Median Sales Price for Brevard Single Family homes is down -1.1% to $375,000 compared to a year ago, which was $379,125.

- Months’ Supply of Inventory is down -7.5% to 3.7 months, a decrease from 4.0 months in Annual 2024.

- Traditional Sales are up 0.7% with a median sales price of $375,000.

- Foreclosure/REO Sales are up 12.2% with 83 closed sales and a median sales price of $224,500.

- Short Sale Closings are up 225.0% with 26 closed sales and a median sales price of $292,500.

A quick recap of the Brevard County Townhouses/Condos for Annual 2025:

- Closed Sales are down -6.9% for Annual 2025 in which the number of units closed was 2,183 compared to 2,346 in Annual 2024, with a decrease in cash sales of -4.8%.

- New Pending Sales are down -6.4% and New Listings are down -0.8%.

- The Median Sales Price for Brevard Townhouses/Condos is down -5.1% to $280,000 compared to a year ago, which was $295,000.

- Months’ Supply of Inventory is 0.0% to 7.1 months, no change from 7.1 months in Annual 2024.

- Traditional Sales are down -7.3% with a median sales price of $281,000.

- Foreclosure/REO Sales are up 55.6% with 14 closed sales and a median sales price of $150,500

- Short Sale Closings are N/A with 3 closed sales and a median sales price of $242,500.

Interesting in moving to Brevard?

Contact me for a consultation by filling out the information below:

You must be logged in to post a comment.